|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

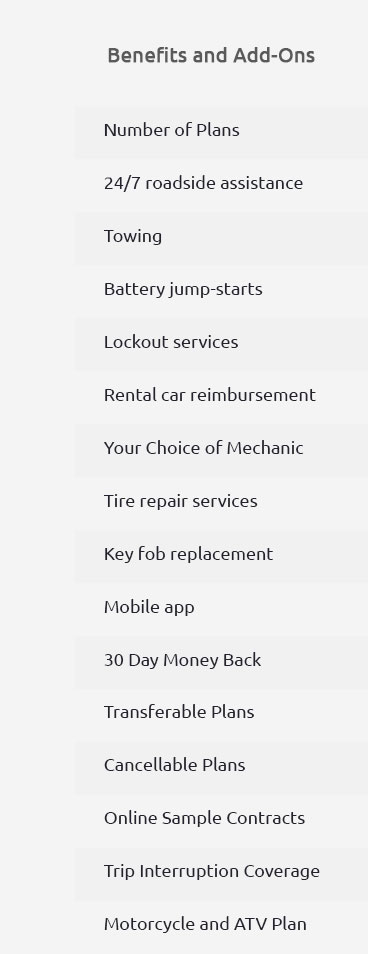

Mechanical Breakdown Insurance Reviews: Coverage Guide for U.S. ConsumersWhen it comes to protecting your vehicle, understanding mechanical breakdown insurance (MBI) is crucial for U.S. consumers. This coverage is designed to help you save money on costly repairs and provide peace of mind as you drive. What is Mechanical Breakdown Insurance?Mechanical breakdown insurance is a type of coverage that pays for car repairs due to mechanical failures, not caused by accidents or regular wear and tear. It acts similarly to an extended auto warranty, but with some key differences. Key Benefits

How Does It Compare to Extended Auto Warranties?While both MBI and extended warranties offer similar protections, MBI is typically purchased through an insurance company, providing a seamless addition to your existing auto policy. For instance, if you're considering a vw warranty powertrain, comparing it with MBI options can help you make an informed decision. Cost ConsiderationsCosts for MBI can vary based on vehicle make, model, age, and mileage. For example, consumers in Los Angeles may find prices differ significantly compared to those in smaller towns. Real-World ExamplesLet's say you're driving through the bustling streets of New York City, and your car suddenly breaks down. With MBI, those unforeseen repair costs might be covered, allowing you to continue your journey with minimal disruption. Coverage Inclusions

Exploring options like the infiniti elite warranty alongside MBI can ensure you choose the best fit for your needs. FAQs About Mechanical Breakdown InsuranceIs Mechanical Breakdown Insurance Worth It?Yes, for many drivers, MBI provides valuable coverage that can lead to significant savings on repair costs, especially for high-mileage vehicles. What Vehicles Are Eligible for MBI?Most newer vehicles with low mileage are eligible. However, eligibility criteria can vary by insurer, so it's important to check specific policy details. How Does MBI Affect My Auto Insurance?MBI is typically added to your existing policy, which may slightly increase your premium but can offer significant savings and coverage. In conclusion, mechanical breakdown insurance provides U.S. drivers with a reliable option for protecting their vehicles against costly repairs. Whether you're navigating the highways of California or the urban landscapes of New York, MBI offers valuable peace of mind and financial security. https://www.caranddriver.com/car-insurance/a36395439/mechanical-breakdown-insurance/

MBI provides coverage when main systems such as the transmission or engine fail. The insurance is similar to an extended warranty provided by a vehicle ... https://wallethub.com/edu/ci/mechanical-breakdown-insurance/72715

Mechanical breakdown insurance (MBI) is worth it for cars that are expensive to repair, such as a Tesla or BMW, or if your car is likely to break and you're ... https://www.macanforum.com/threads/your-experience-with-geico-mbi-good-meh-or-bad.172883/

Mechanical Breakdown Insurance coverage is in excess of coverage provided by your manufacturer's warranty. Read the policy amendment for the ...

|